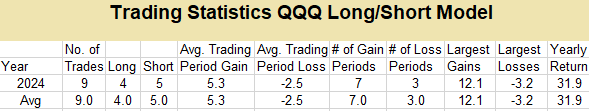

Definition of headings in the tables below (each row/line relates to a specific year):

• No. of Trades – total number of trades

• Long – number of long positions

• Cash – number of hold cash positions

• Short – number of short positions

• Avg. Trading Period Gain – the average percentage gain of the profitable trades

• Avg Trading Period Loss – the average percentage loss of the nonprofitable trades

• No. of Gain Periods – the number of trades that were profitable

• No. of Loss Periods – the number of trades that were nonprofitable

• Largest Trading Period Gains – the largest percentage profitable trade

• Largest Trading Period Losses – the largest percentage nonprofitable trade

• Yearly Return – percentage sum of of all profitable and nonprofitable trades

Special Note: Short sell positions (shown in the below tables) can be replaced with the inverse fund ProShares Short QQQ (PSQ) (-1x). PSQ seeks a return that is -1x the return of an index or other benchmark (target) for a single day, as measured from one NAV calculation to the next. Other inverse and leveraged Nasdaq-100 ETFs can be found on here.

Both systems — (1) Long/Short & Long/Short/Cash Models, and (2) Aggressive & Moderate Models were running simultaneously in Year 2024. We decided to end the Aggressive and Moderate Models at the end of Year 2024, and continue with the Long/Short & Long/Short/Cash Models. Through extensive backtesting, the Long/Short & Long/Short/Cash Models are producing higher returns using the new and improved mechanical rules-based system.

Long/Short Model

The Long/Short model began on January 1, 2024.

Long/Short/Cash Model

The Long/Short/Cash model began on January 1, 2024.

We discontinued the Aggressive and Moderate Models on December 31, 2024. Below are the statistical results.

Aggressive Model

Moderate Model

|